Esha Dey

Tue, Jun 24, 2025, 2:40 AM 3 min read

In This Article:

(Bloomberg) — As tensions in the Middle East mounted to start the week, Wall Street strategists had a message for US equities investors: Stay calm and buy into market declines. The call looked prescient on Tuesday after President Donald Trump announced a ceasefire between Israel and Iran.

Most Read from Bloomberg

-

Bezos Wedding Draws Protests, Soul-Searching Over Tourism in Venice

-

US State Budget Wounds Intensify From Trump, DOGE Policy Shifts

-

Commuters Are Caught in Johannesburg’s Taxi Feuds as Transit Lags

Both Paul Christopher of Wells Fargo Investment Institute and Sam Stovall of research firm CFRA suggest that long-term investors should buy information technology, communication services and financials. Dennis DeBusschere of 22V Research favors growth and momentum stocks.

The recommendations indicate a departure from the typical wisdom offered during times of war and uncertainty, when the move is usually to dive into defensive stocks. Strategists are confident that the Iran-Israel conflict won’t have a lasting impact on stocks and that technology companies — often known for their bullet-proof balance sheets and strong cash piles — will provide shelter should tensions flare.

“The historical experience thus far has been that — especially geopolitical risks — have managed to be contained every time and the market has become accustomed to that,” Barclays strategist Venu Krishna said in an interview with Bloomberg TV on Monday. “Hence we’re extrapolating that once again.”

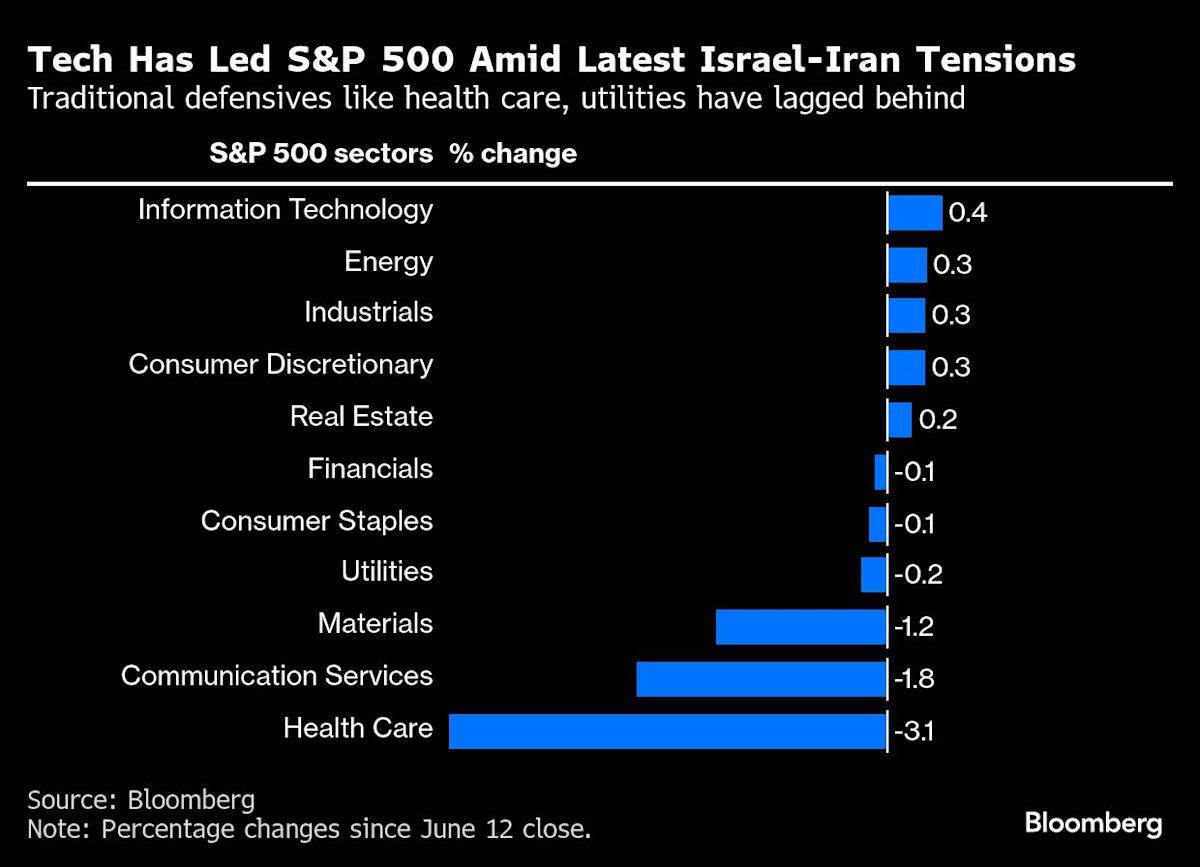

So far, traders seem to be taking note. On Monday, the S&P 500 rose nearly 1% after a brief decline, buoyed by technology stocks, with Iran’s retaliatory strikes at a US air base in Qatar seen as symbolic. Since the latest Iran-Israel strife began in mid-June, the S&P 500 has been led by the technology companies, while health-care — a defensive sector — has been the biggest decliner.

“Being defensive is betting on a market decline — that is something we don’t see happening,” said Michael Kantrowitz, chief investment strategist at Piper Sandler & Co. “As long as earnings estimates continue to grind higher, 10-year Treasury yield stays below 4.5%, and oil below $85, we think markets will continue to grind higher.”

The 10-year Treasury yield is trading just below 4.4% on Tuesday, while West Texas Intermediate crude futures dropped to as low as $64.4 a barrel.

Growth View

Morgan Stanley strategist Michael Wilson also remains bullish, saying the US involvement over the weekend was unlikely to disrupt the firm’s view that US companies will experience growth in the next six to 12 months. That outlook will remain intact unless there’s a significant spike in oil prices, he said.

![Sunday is the last day to take advantage of the Chase refinance mortgage rate sale [Expired]](https://thenewsblend.com/wp-content/uploads/2025/12/eed000a0-caf6-11f0-baaf-499d9d48b516-768x512.jpg)