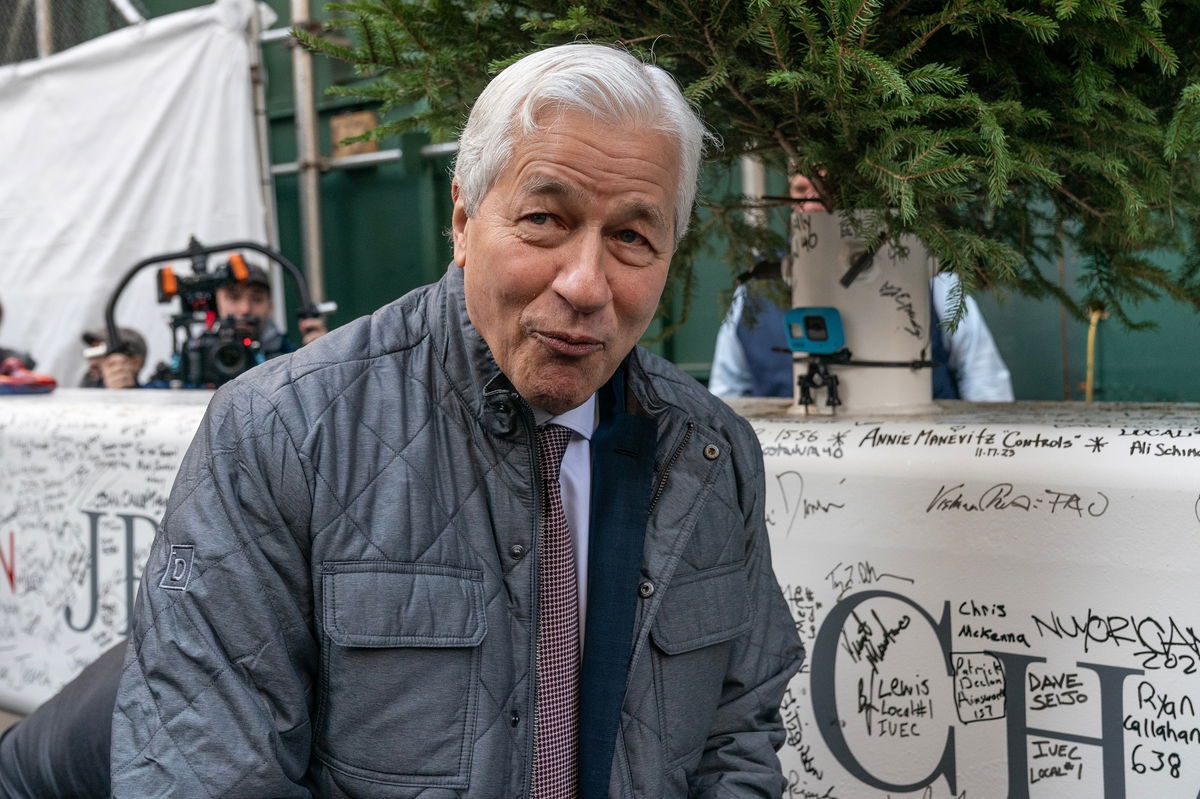

JPMorgan CEO makes dramatic U-turn regarding Bitcoin | Credits: lev radin/ Shutterstock

Cryptocurrency is here to stay; it is a cliché and old adage crypto natives would repeat over and over, hoping it would one day come true. And with Jaimie Dimon making a complete U-turn on Bitcoin, it seems to be working out for them.

Dimon, the CEO of JPMorgan, who for many years advocated against cryptocurrency and more specifically against bitcoin, saying it’s a scam, and only used for money laundering, sext trafficking and terrorism, now announces his bank will allow its clients to purchase BTC.

“I’ve always been deeply opposed to crypto, Bitcoin, etc.,” he said during a Senate Banking Committee hearing in 2023. “The only true use case for it is criminals, drug traffickers, money laundering, and tax avoidance. If I were the government, I’d close it down,” he said.

Done talking about Bitcoin

On January 17, 2024, Dimon said he was done talking about bitcoin, CNBC had reported.

“This is the last time I’m talking about this with CNBC, so help me God,” Dimon said. “Blockchain is real. It’s a technology. We use it. It’s going to move money, it’s going to move data. It’s efficient. We’ve been talking about that for 12 years, too, and it’s very small.”

“There’s a cryptocurrency which might actually do something,” Dimon said of smart chain-enriched blockchains. “You can use it to buy and sell real estate and move data — tokenising things that you do something with.”

“And then there’s one which does nothing,” Dimon said of bitcoin. “I defend your right to do Bitcoin. I don’t want to tell you what to do. So my personal advice would be, don’t get involved. … But it’s a free country.”

The 180 shift on Bitcoin

“We are going to allow you to buy it,” Dimon said at JPMorgan’s annual investor day on May 19. “We’re not going to custody it. We’re going to put it in statements for clients.”

CNBC reported that Dimon also commented on his long-held scepticism about cryptocurrency.

“I don’t think you should smoke, but I defend your right to smoke. I defend your right to buy Bitcoin,” he said on CNBC.

CNBC added that JPMorgan will offer clients access to Bitcoin exchange-traded funds (ETFs), citing sources familiar with the situation.

Until now, the firm has limited its crypto exposure primarily to futures-based products, not direct ownership of digital assets, Cointelegraph reported.

JPMorgan competitor Morgan Stanley has also moved to offer spot Bitcoin ETFs to qualifying clients. Spot Bitcoin ETFs in the US have seen significant adoption, with almost $42 billion in total aggregate inflows since they launched in January 2024.