Anthony Di Pizio, The Motley Fool

Wed, Apr 9, 2025, 1:56 AM 6 min read

In This Article:

The Nasdaq Composite (NASDAQINDEX: ^IXIC) includes almost every company listed on the Nasdaq stock exchange, so it’s often a good proxy for the performance of the broader technology industry. As of the close on Friday, April 5, the index was down by 22% from its all-time high, which officially places it in a bear market.

The sharp sell-off was triggered by President Donald Trump’s tariff announcement last week, which will raise the price of all imported goods flowing into the U.S. Countries including China have already implemented tariffs in retaliation, so investors are concerned about the possibility of a global trade war, which could hurt economic growth.

That would be a bad thing for all American companies, but some could suffer a lesser impact than others because they aren’t directly subject to tariffs.

For example, software and digital products were excluded from Trump’s initial round of penalties, so companies like CrowdStrike Holdings (NASDAQ: CRWD) and Duolingo (NASDAQ: DUOL) should remain mostly unscathed (for now). Here’s why investors with a spare $650 might want to buy one share in each of them during the Nasdaq bear market, with the intention of holding on for the long term.

CrowdStrike is one of the world’s largest cybersecurity companies. Its Falcon platform is a rare all-in-one solution for businesses, featuring 29 modules that protect cloud networks, employee identities, endpoints (computers and devices), and more. Falcon uses artificial intelligence (AI) to autonomously detect and neutralize threats, creating a seamless user experience especially for businesses without in-house cybersecurity managers.

Its AI models are trained on 2 trillion security events each day, and they make 180 million indicator-of-attack (IoA) decisions every single second. An IoA is a pre-breach signal that often precedes a serious attack, so the more of these Falcon sees, the smarter its AI models become over time.

At the end of CrowdStrike’s fiscal year 2025 (Jan. 31), a record 67% of Falcon customers were using five modules or more, which was up from 64% in the prior-year period. It highlights how businesses need an expanding number of products to protect themselves as they shift more of their operations online.

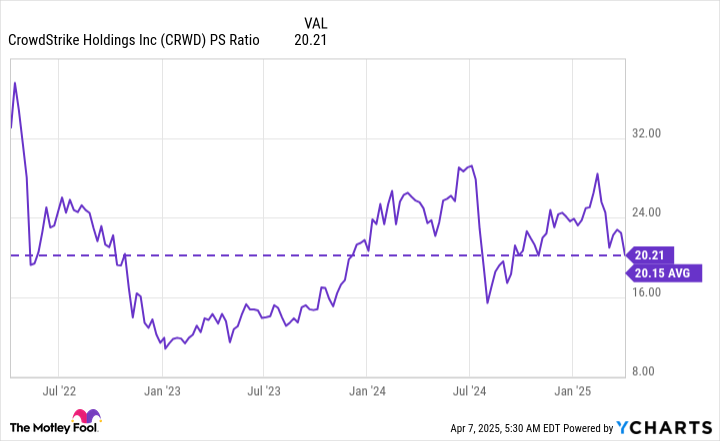

The company ended fiscal 2025 with $4.2 billion in annual recurring revenue (ARR), which was a 23% increase from the prior year. Since its stock has declined 29% from its recent all-time high, its price-to-sales ratio (P/S) is now just 20.2, which is roughly in line with its three-year average:

![Sunday is the last day to take advantage of the Chase refinance mortgage rate sale [Expired]](https://thenewsblend.com/wp-content/uploads/2025/12/eed000a0-caf6-11f0-baaf-499d9d48b516-768x512.jpg)