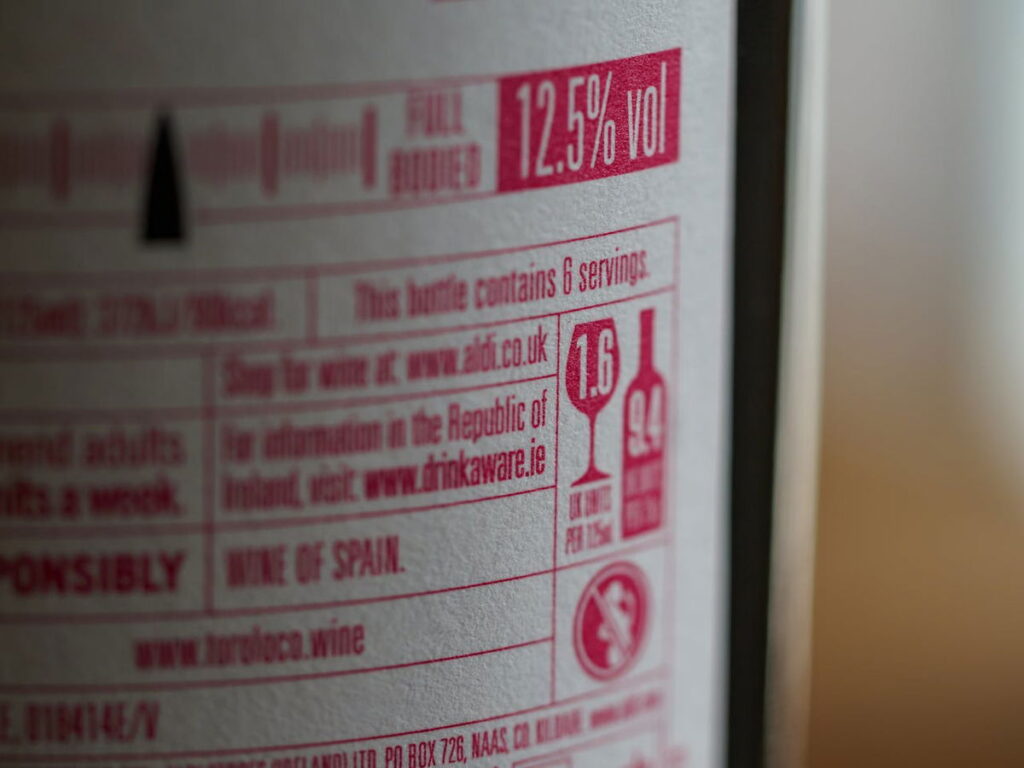

Spanish red wine, 12.5% volume. Credit: Brett Jordan, Pexels

Spanish winemakers are warning of an export crisis after the UK’s new alcohol-based wine tax, introduced in February 2025, triggered a sharp 7.5 per cent drop in Spanish wine exports to Britain – their largest still wine market.

According to Reuters data, cited by the Spanish Wine Interprofessional Organisation, the value of Spain’s wine exports to the UK fell to €111 million in the first four months of 2025, outpacing declines from both France (-6 per cent) and Italy (-6.7 per cent).

New UK tax targets high-percentage wines

The UK’s updated tariff system taxes wine based on alcohol strength rather than liquid volume. As a result, Spanish reds – known for their higher alcohol content due to warmer growing conditions – are now “most penalised by the tax increase,” said José Luis Benítez, director of the Spanish Wine Federation, cited by Majorca Daily Bulletin.

Benítez noted the system “favours beers… and some sparkling wines,” further squeezing Spain’s export competitiveness in a post-Brexit market already hit by increased paperwork and costs.

British importers must now pay more for wines above 12.5 per cent alcohol – a category that includes many classic Spanish reds. These tax hikes are pushing retail prices higher and damaging long-standing trade relationships.

Spanish wine exporters say they are losing ground in Britain because of the new pricing pressures. “It’s putting our prices much, much higher,” said Nicola Thornton, founder of the Spanish export company Spanish Palate. “The tax is definitely a conversation that’s in the foreground. Everyone is asking: what’s the alcohol level?”

British buyers are reportedly paying around 20 per cent more for many full-bodied reds, which has triggered a move by some importers toward lighter wines (11.5–12 per cent ABV) – a shift that may not sit well with traditional consumers.

US market steps in

While UK sales have dropped, Spanish wine exports to the US rose 9 per cent in the same period to €119.6 million, driven by strong importer demand and fears of possible future US tariffs. But experts say this alone may not be enough to offset the UK decline.

This shift in UK tax policy could have global implications. As climate change continues to raise grape sugar levels – and therefore alcohol content – wine producers in warmer regions like Spain may face more regulation-induced hurdles in the years ahead.

Should a country’s climate and tradition be taxed into submission? Or should wine tariffs reflect more than just alcohol percentage?

View all business news.